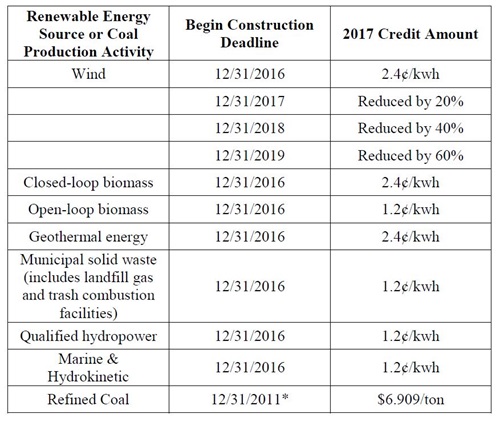

The IRS recently released the inflation adjustment factor and reference prices for the 2017 calendar year, which are necessary for calculating the Section 45 production tax credits. Based on the 2017 inflation factor of 1.5792, there is an increase for 2017 in the tax credit amounts for electricity generated from wind, closed loop biomass and geothermal. The 2017 tax credit amounts for renewable energy production and refined coal production are set forth below.

*Placed in service deadline

2017 Reference Prices; No Tax Credit Phase-out

If the reference price for a particular energy source, as published by the IRS, exceeds a certain designated level, then the Section 45 production tax credit will be reduced or completely phased out. Based on the 2017 reference prices, there will be no phase-out for any of the renewable energy sources or refined coal production activities for the 2017 calendar year.

The 2017 reference price for wind is 4.55 cents/kilowatt hour. Since this reference price does not exceed 12.63 cents/kilowatt hour (i.e., 8 cents multiplied by the 1.5792 inflation factor for 2017), there will be no phase-out during 2017 of tax credits realized from the sale of electricity produced from wind energy. Similarly, the 2017 reference price for refined coal is $51.09/ton. Since this reference price does not exceed $85.64/ton (i.e., $31.90 multiplied by 1.5792 inflation factor and 1.7), there will be no phase-out during 2017 for tax credits realized from the sale of refined coal.

The IRS still has not determined reference prices for electricity produced from closed-loop biomass, open-loop biomass, geothermal, municipal solid waste, qualified hydropower and marine and hydrokinetic energy. Accordingly, there will be no phase-out during 2017 for tax credits realized from these renewable sources.

For more information regarding Section 45 production tax credits, please contact the following Barnes & Thornburg LLP attorneys: Bill Ewing at william.ewing@btlaw.com or 404-264-4050; Jim Browne at jim.browne@btlaw.com or 241-258-4133; or Ralph Dudziak at ralph.dudziak@btlaw.com or 312-214-5618.

© 2017 Barnes & Thornburg LLP. All Rights Reserved. This page, and all information on it, is proprietary and the property of Barnes & Thornburg LLP. It may not be reproduced, in any form, without the express written consent of Barnes & Thornburg LLP.

This Barnes & Thornburg LLP publication should not be construed as legal advice or legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult your own lawyer on any specific legal questions you may have concerning your situation.

Visit us online at www.btlaw.com and follow us on Twitter @BTLawNews.